Florida Retirement Plan Advisors and Their Importance

According to US Census Data, “there are 47.8 million U.S. citizens age 65 and older, representing 14.9 percent of the total population. Their average annual income is $38,515, and average net worth is $170,516, but 8.8 percent have incomes that are at the poverty level.”

Planning your wealth for retirement is probably one of the least-thought-about concerns of managing money. This could be because the young think that their retirement is decades away. Meanwhile, others feel that their existing savings are minimal, so planning for retirement feels hopeless.

The number one financial worry of people of working age, at 64 percent, is that they won’t have enough saved.

However, neither one of these scenarios should impact your retirement planning.

That said, retirement planning can be complex. Getting professional help as early as possible can help increase the likelihood you live a comfortable retired life. Whether you’re young and feel retirement is too far off to worry about, are older and feel your savings are insufficient, or are somewhere in the middle and think you have a good handle on your retirement, a retirement advisor will be able to help you work out the most optimal plan that caters to your needs.

Remember, it’s never too late to start planning for your retirement.

Here are some factors to consider when you start planning your wealth for your golden years.

What Does a Retirement Planner Do?

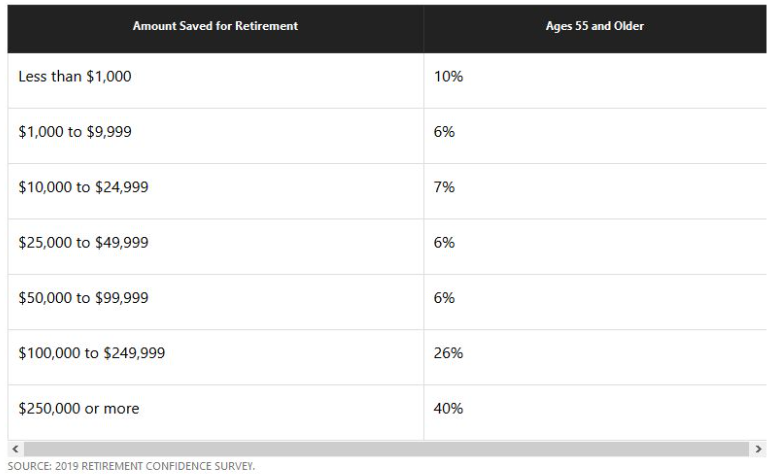

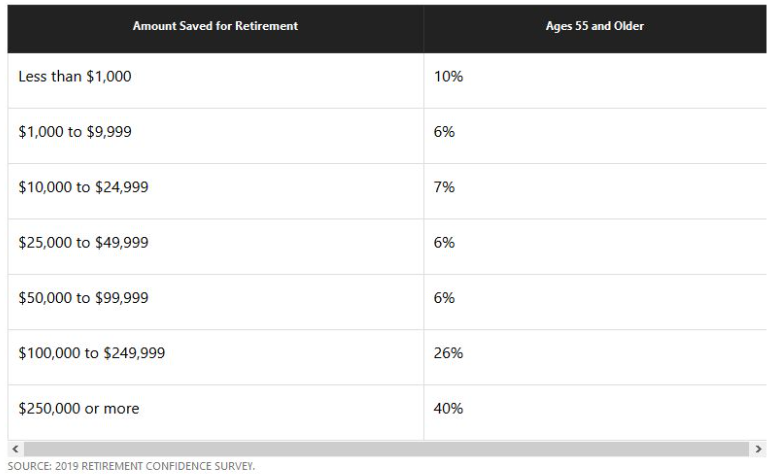

The need for retirement planning is often underestimated. Have a look at the table below to understand the state of affairs.

A qualified and experienced retirement planner can help you with wealth management by understanding your financial goals. He/she can formulate a plan that will convert your financial assets (pension, Social Security, home equity) into monthly paychecks for your post-retirement needs.

Ideally, he/she should have thorough knowledge of Social Security as well as the tax and retirement planning rules to offer sound advice on:

- Beneficial ways of accepting Social Security

- Pension distribution that suits your financial goals and needs

- Annual withdrawal amounts and from which type of accounts

- Minimizing retirement taxes and readjusting investments accordingly

- Getting long-term care insurance

- Amount of money that should be directed towards guaranteed investments

- Moving money into an IRA account

- Maximizing tax-advantaged accounts, such as a 401(k) or individual retirement account

- Paying off your mortgage before or during retirement, or getting a reverse mortgage

- Investments that are most suitable for you and the taxable income they will generate

- Choosing an asset allocation that balances risk and reward

An effective retirement planner will ask about all your investments and create an ironclad portfolio that is optimized to generate consistent retirement income for you.

Why You Need a Retirement Plan Advisor

Retirement plan advisors have in-depth knowledge of the best ways to plan your wealth for your retirement. Upon taking a look at your financial plan, they may be able to advise you on the factors that are working in your favor, and the scope for improvement.

They can help you stay on the right path when the market experiences volatility, deterring you from making the wrong moves at the wrong time.

Further, a retirement plan advisor is aware of the latest regulations and laws on taxes as well as policy changes. This is important if you want to avoid making costly mistakes.

For instance, you may be interested in finding out if there are penalties or tax implications on an early IRA withdrawal. Moreover, you may want to calculate how the withdrawal will impact your long-term savings. A retirement plan advisor will be able to help you through these and other such complex matters.

How to Pick the Right Retirement Plan Advisor

Picking the right retirement plan advisor takes careful consideration of the following matters:

- Compliance with the Fiduciary Standard: Some professionals may advise you on suitable investments. Go for a planner that operates under the fiduciary standard as he/she will go a step further than suitability and recommend plans that are in your best interest.

- Ask for Qualifications: Pick a certified financial planner who is qualified and operates in keeping with the fiduciary standards. Such a planner is regulated as well as licensed to help you with your wealth management needs. Look for designations with regulatory bodies and ethical standards including Certified Financial Planner® and Certified Investment Management Analyst®.

- Trust Reliable Sources: Looking in the right places will help you choose a good retirement planner. It is a good idea to refer the National Association of Personal Financial Advisors or Schwab’s Independent Advisor database. You can also seek references from family and friends.

- Ask Questions: Once you’ve shortlisted a few candidates to be your retirement planner, speak to them and ask some important questions. Enquire about their experience in the business and references of their past clients. Find out about their areas of specialization. A planner who specializes in saving for higher studies may not be able to help you with your retirement needs. See if he/she can explain some complex financial terms to you in lucid language. Avoid anyone who makes unrealistic guarantees (for example, I can triple your money in 2 years) at all costs.

How Much Do Retirement Planning Advisors Charge?

The fees may vary. Retirement planners in Gainesville, Florida may charge:

- An hourly fee

- A flat fee

- A retainer fee on a quarterly/annual basis

- A percentage of assets that they manage for you

- Commissions from financial/insurance products you buy through them

- A combination of fees and commissions

It is a good idea to ask a potential retirement planner for a detailed explanation of how they prefer to be compensated.

7 Useful Retirement Planning Tips to Consider

- Prepare before Retiring: Not overspending before retiring is the number one rule for retirement saving. Apart from that, you should start looking for investment options that provide predictable income. However, the more predictable the income is, the lower the return will be. Planning for retirement will need you to talk to your spouse about your spending plan. It is always recommended for couples to openly discuss their financial and retirement plans so both partners are on the same page.

- Plan for Inflation: Inflation and increasing costs have the power to lower the value of your retirement savings. Hence, always assume that prices will keep rising when planning before retirement so you’re adequately prepared.

- Be Physically Fit: With the constantly increasing healthcare costs, your physical fitness plays a direct role in your retirement plans. As you grow older, healthcare costs will most likely rise. These costs are often overlooked by retirees as they fail to plan for them, and can burden your finances. Hence, you will do well to focus on being physically fit to minimize healthcare expenses.

- Create a Budget to Control Expenses: Making a budget will help you understand how much money you have and how much you can spend in retirement. You can calculate your annual spending with the help of a professional retirement planner in Florida. He/she may be able to provide you with additional insights and tools so you’re able to stick to your budget effortlessly.

- Pay off Mortgage: Apart from holding emotional value, your home in Gainesville also makes up a significant part of your fixed expenses. Paying off your mortgage earlier on will enable you to tap into your home’s wealth as you will be living rent-free, thereby eliminating a considerable monthly cost.

- Work a Few More Years: A great way to ensure you have sufficient wealth at the time of retirement is to work a few additional years beyond what you originally planned. While it may seem like more hard work, doing so will make you more financially independent and confident going forward. Working for even a couple of years more can add considerably to your retirement fund.

- Prepare for the Worst: Preparing to face financial difficulties will be the biggest favor you will do for your post-retired self. Regardless of the planning and budgeting, unexpected expenses are bound to occur. It is best to budget for such expenses and set aside some money for them. Remember, certain costs such as property taxes and household maintenance costs may rise significantly during retirement.

Conclusion

Retirement planning should never be a DIY task unless you have a thorough understanding of all the elements at play. Even expert retirement advisors will tell you that this kind of planning can be complicated, and result in poor decision-making. However, it is an increasingly important aspect of living a comfortable and fulfilled retired life.

Whether you’re looking to save up or have already retired and want to generate income through your assets, a financial advisor will be able to put you on the right path to meet your goals. Do bear in mind that not all financial advisors specialize in retirement planning. Be sure to choose your retirement advisor wisely with the help of the tips mentioned above.